Art City

Springville, UT

Utah County (Provo/Springville area) tops the list of growth areas in the US for the 20+ year timeframe. This mixed-use development has 41 3br/2ba units, 58 climate controlled storage units, and 4 offices. Construction was completed and we purchased the asset from our developer partner in April 2018.

Windsor Park

Salt Lake City, UT

60 apartments units in Salt Lake City acquired March 2018. The property is solid but dated, offering strong upside in rents with strong tenant demand from the nearby airport and easy downtown commute. The purchase was the back end of a 1031-Exchange, trading a SF Bay Area 4-plex for 60 units.

The Point on Flamingo

Las Vegas, NV

This 192-unit property borders the University of Las Vegas on two sides. We just completed a $5Million rehab to convert it to a 380-bed full-service student housing community rented by the bed.

Main and Hertel

Buffalo, NY

321-unit student housing development next to the University at Buffalo, NY. After buying an industrial site in 2017, all entitlements were obtained during a seller leaseback period. Toxic remediation started in fall 2018 with construction scheduled to start in December 2018 and complete in summer 2020.. The project is well located next to both metro and bus stops and at the end of the prime eatery and café street, and well timed, given Buffalo’s 2017 economic surge.

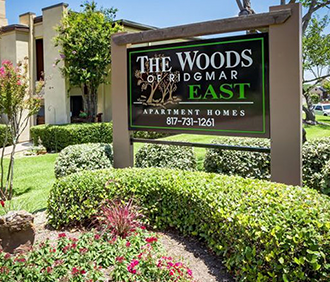

Woods of Ridgmar

Forth Worth, TX

235-unit property acquired in December 2016 as a value-add project. Higher end finishes on remodelled units have brought significant rent bumps on unit turns and a strong tenant base continues to drive demand for this asset.

Long Cove Resort

Charlotte, NC

This formerly run-down Marina & RV park was acquired in March 2016 and is being turned into a high-end tiny home / glamping (glamorous camping) resort 20 minutes from downtown Charlotte, NC. About half of the planned thirty six cabins are operational, being rented for up to $200/night on a space previously rented for $300/mo. Resort bookings and NOI have steadily increased as the new amenities draw a higher tenant base.

South Lakeside

Chicago, IL

This 237-unit property in South Shore, Chicago retains magnificent charm and architecture of the early 1900s. The property had been mismanaged with economic occupancy below 50% upon acquisition, end of 2015. The property is at 80% economic occupancy and rising, with rent increases in 2018 alone averaging $120/mo.

River Ridge

Tulsa, OK

27-unit on a bluff overlooking the river, just down the street from a new $1Billion “park” project that just opened fall 2018. The property was in poor shape when acquired in 2015. An $800k rehab has transformed it, and taken rents form $425/mo to $700. With the opening of the park, we expect rents to rise another $50-$100.

Villas Del Lago

Dallas, TX | SOLD

248-unit apartment building in the Bachman Lake area of Dallas, purchased spring 2014. Sold for nearly 80% over purchase price after 21 months of ownership. Gross income increased from under $110k/mo to $160k/mo. 65+% annual return to investors.

Chancellor

Houston, TX | SOLD

224-unit multi-family property in Houston, TX. Acquired in Feb 2014 for $7.6MM. Only a few months into rehab we received an offer for 50% higher, and ultimately sold in March 2016. Approximately 39% average annual returns to the investors.

Tree House

Longview, TX

172-unit value-add project 2 hours east of Dallas, purchased in 2013. The property was running at 98% occupancy with rents $100 higher than at purchase before the slump in oil prices affected the market. Property is cash flowing but not the way it was then, and has recently been put on the market for sale.

La Siera

New Braunfels, TX | SOLD

152 unit multi-family in the San Antonio growth corridor. Purchased in 2012, this was FAI’s first foray into larger apartment complexes and run by a senior partner. Sold in 2016 with average annual returns to investors of 28%.

© 2018 Financial Attunement Inc. All rights reserved.

Disclaimer: This webpage is for information purposes only. This is not an attempt to sell interests in a security. Offers to sell an interest in any of our properties will only be made to a qualified purchaser by the delivery of the confidential private placement memorandum and current supplements, accompanied by a subscription document booklet. Please reference confidential private placement memorandum for full details. Preferred return is subject to availability of cash flow.